Catastrophic Borrowing Kills Global Financial System – John Rubino

Medeea Greere, an independent publisher, is now on Telegram at https://t.me/AMGNEWS2022 and exists only on reader support as we publish Truth, Freedom and Love for public awareness. Thank You for your support!

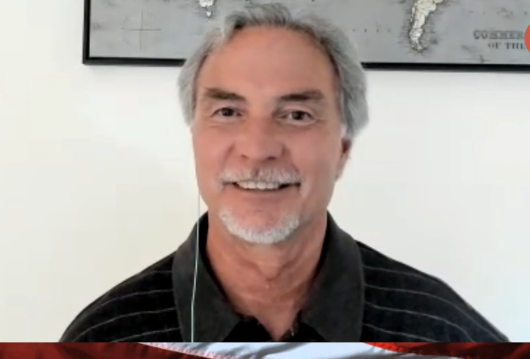

Analyst and financial writer John Rubino says this time, the so-called debt ceiling fight could end in a systemic failure. Rubino points out, “In a well-run society, the debt limit would be zero. Governments should not borrow money in the first place. The amount of money we are borrowing is catastrophic. Historians are going to look back at this era, and they are just going to wonder why we allowed it to happen and what were we thinking. We are destroying the global financial system by allowing governments to borrow this much money.

The debt limit thing is being called a crisis, and if they let it go too far, it will be a crisis. . . . I think this game of chicken will end in the not-too-distant future, and if it doesn’t, they have an ulterior motive. They want to crash the economy because that achieves something for them. We can speculate about this. The party in power wants to crash the economy, and that is a very dark scenario. . . . They are willing to burn down the world around them to get what they want. Look at Russia-gate and the contents of the Durham Report. The Democrats are willing to do stuff like that. . . . I would not put it past the Democrats to plan and implement it if they think it benefits them.”

The economy is already doing bad and getting ready to tumble. So, why not tank it with a debt ceiling impasse and blame it on the Republicans? Some speculate that is the Dem plan because the Obama/Biden economy is going down anyway.

If the economy sinks low enough, how much money will the Fed print to bail it out. Treasury Secretary Janet Yellen is already warning there is going to be more bank consolidation. In other words, more banks will be going under. Rubino says that is a huge worry and explains, “The dark part of this scenario is the government has to step in and bail out those little banks.

Let’s say it’s a couple of trillion dollars . . . to them, it’s play money . . .but what if the markets look at that and say what happens if all the other sectors blow up and the government has to come up with $10 trillion or $15 trillion? What does that do to the dollar? Then you go from a banking crisis to a currency crisis, which is almost impossible to contain. I think it is completely possible that we go to that next stage.”

There is much more in the 38-minute interview.

Join Greg Hunter as he goes One-on-One with financial writer John Rubino and his new enterprise called Rubino.Substack.com for 5.20.23.

(To Donate to USAWatchdog.com Click Here)

(Tech Note: If you do not see the video, know it is there. Unplug your modem and plug it back in after 30 sec. This will clear codes that may be blocking you from seeing it. In addition, try different browsers. Also, turn off all ad blockers if you have them. All the above is a way to censor people like USAWatchdog.com.)

Source: https://usawatchdog.com/catastrophic-borrowing-kills-global-financial-system-john-rubino/

Our mission to champion democracy, freedom of speech, and patriotic values relies on the support of dedicated individuals like you. Your contribution is vital in helping us provide insightful analysis, uncover pressing issues, and inspire positive change in our nation.

Join us in our commitment to making a difference. Every donation counts and empowers us to continue our work in advocating for the values we hold dear.

Thank you for being a crucial part of our journey.

I’m a 33-year-old writer and the founder of World Reports Today. Driven by the timeless principles of democracy and freedom of speech, I use my platform and my writing to amplify the voices of those who uphold these ideals and to spark meaningful conversations about the issues that truly matter.